What the Finance Industry Tells Us About the Future of AI

Harvard Business

AUGUST 9, 2023

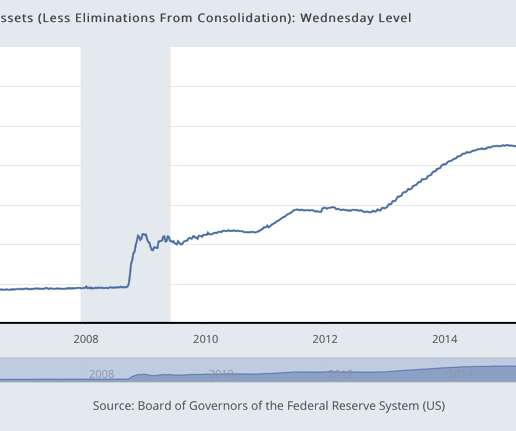

For a preview, look to the finance industry which has been incorporating data and algorithms for a long time, and which is always a canary in the coal mine for new technology. The experience of finance suggests that AI will transform some industries (sometimes very quickly) and that it will especially benefit larger players.

Let's personalize your content