Two Factors that Determine When ESG Creates Shareholder Value

Harvard Business

FEBRUARY 7, 2024

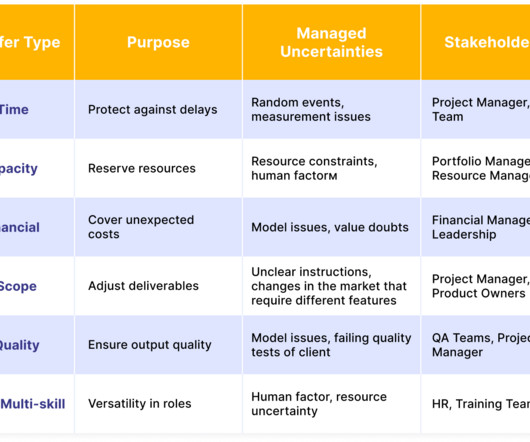

The paper “Corporate Sustainability: First Evidence on Materiality,” published in 2016, marked a significant shift in perceptions of corporate sustainability. These findings underscore the importance of ESG efforts in resource allocation and their potential to attract investment by demonstrating a tangible impact on shareholder value.

Let's personalize your content