Wealth Management 101: The Hidden World of Private Banking

Tom Spencer

JUNE 30, 2023

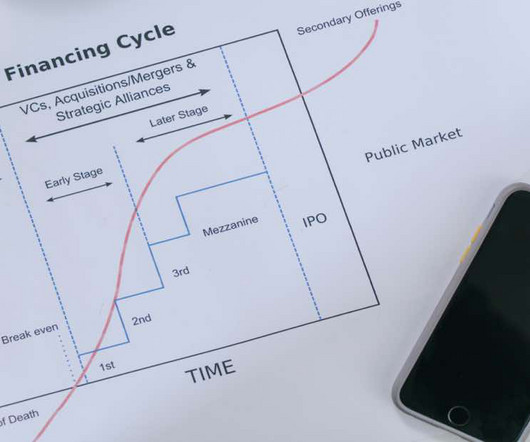

The financial services industry comprises firms that operate across a range of sectors: Asset & Wealth Management, Banking & Capital Markets, and Insurance. In simple terms, asset management firms are the ‘manufacturers’ of investment products (e.g., clients can purchase iShares on the RBC Wealth platform).

Let's personalize your content