The Cyber Insurance Market Needs More Money

Harvard Business

MARCH 10, 2022

Securities could help give insurers the breathing room they need to keep growing — and meet customers’ mounting needs.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Tom Spencer

APRIL 14, 2023

Wealth management is a critical field that helps high net worth individuals and families to achieve their financial goals and maintain their financial assets over the long-term. Wealth managers assist their clients to do this through a combination of strategies involving financial planning, investment management, and risk management.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Tom Spencer

JUNE 30, 2023

The financial services industry comprises firms that operate across a range of sectors: Asset & Wealth Management, Banking & Capital Markets, and Insurance. Wealth Management vs Asset Management Many people interchangeably use the term asset and wealth management.

Successful Independent Consulting

OCTOBER 27, 2023

They don’t know to add a hefty margin to cover things like self-employment tax, business expenses, health insurance, and nonbillable time spent on business administration. Use these sites even if you just left your corporate job because it’s possible your cost-of-living increases didn’t keep up with the market price for your expertise.

Tom Spencer

DECEMBER 1, 2018

The cloud – which refers to storing, managing, and processing data via a network of remote servers instead of locally on a server or personal computer – is quickly becoming a critical source for innovation. Cloud in the Insurance Sector. However, more widespread reliance on the cloud should proceed with caution.

Tom Spencer

OCTOBER 20, 2018

Insurance industry observers, for their part, believe that the innovative distributed ledger could introduce a variety of improvements and efficiencies to the insurance landscape, and have the following four applications: Fraud detection. Identity management. Peer-to-peer insurance. Identity Management.

Tom Spencer

OCTOBER 6, 2018

Digital disruption is touching every aspect of the consumer market, including the insurance industry. Traditionally, the insurance industry has lagged behind other sectors in the shift into digital technologies, its business model proving to be remarkably resilient. Artificial Intelligence.

Business Consulting Agency

JANUARY 31, 2024

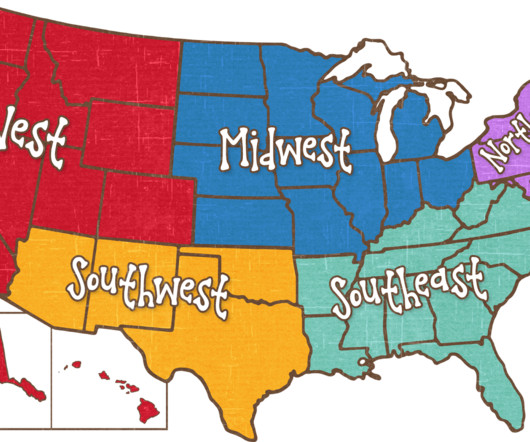

Expanding business operations into the lucrative and dynamic United States market is a strategic move that can yield significant rewards for foreign companies and investment groups. Get started with this US business guide for foreign companies, entering the US market. If more assistance is required, talk to a business consultant.

Jacq Hackett Consulting

JUNE 10, 2018

Here are my top tips for managing your self-doubt. Organise insurance. Take marketing action. The imposter syndrome moves in, and instead of going out and marketing themselves, they stay under the radar hoping clients will find them. But you absolutely need to get out there and proactively market yourself.

BCG

DECEMBER 15, 2016

Article Thursday, December 15, 2016 Life insurers are feeling the squeeze. Yet that income stream is weakening, as low-risk investment yields dip toward 0% and central banks continue to drain the bond markets. How do we manage capital consumption and the volatility of our assets? Can we cut costs to boost overall profit?

MishTalk

JANUARY 23, 2014

per cent in the 12 months to October, according to Factset, a market data company that compiles a consensus of analysts’ forecasts. Cash Cow Capex Thesis vs. Liquidity Insurance Thesis Nick Nelson has it correct. Much of the cash on hand is nothing but insurance against the same thing happening again.

Tom Spencer

MAY 18, 2019

Asset managers are institutions that ‘manage money’ on behalf of certain beneficiaries. Well, asset managers aim to understand client investment objectives and invest client funds in a variety of financial products and asset classes. Major traditional asset managers include: Blackrock. Affiliated Managers.

Successful Independent Consulting

FEBRUARY 12, 2021

Money management · Cash flow – This is probably the hardest part about being self-employed, especially if you are going to work with large companies. A lot of consulting boils down to contracting effectively (clarifying scope and estimated effort), managing expectations, and being an exceptional listener. Be honest with yourself.

Jacq Hackett Consulting

JUNE 10, 2018

Here are my top tips for managing your self-doubt. Organise insurance. Take marketing action. The imposter syndrome moves in, and instead of going out and marketing themselves, they stay under the radar hoping clients will find them. But you absolutely need to get out there and proactively market yourself.

Tom Spencer

OCTOBER 16, 2021

The value of green bonds traded in the market is projected to skyrocket from around EUR 670 billion in 2020 to EUR 2 trillion by 2023. An interesting new set-up is parametric insurance, where payouts are based on the severity of the trigger event, not on the value of assets actually lost. Resilience Bonds. Final thoughts.

Harvard Business

DECEMBER 5, 2017

There is little doubt that the widespread adoption of autonomous vehicles will have a huge impact on the automobile insurance industry. Since insuring privately owned vehicles is what the auto insurance industry has been all about, insurers have every reason to be concerned about their future growth and profitability.

Harvard Business

MARCH 21, 2017

The question of whether the United States will have functioning markets where individuals can buy health care insurance lies at the heart of the current debate about repealing and replacing the Affordable Care Act (ACA). First, these insurance markets were distressed before the enactment of the Affordable Care Act.

IMC USA

JANUARY 20, 2011

PROFESSIONAL LIAIBILITY INSURANCE TO ITS MEMBERS. January 15, 2011) – Affinity Insurance Services, Inc. , a subsidiary of Aon , along with the Institute of Management Consultants (IMC), announced today that Aon will be the exclusive administrator of its Professional Liability insurance program to IMC’s members.

Business Consulting Agency

APRIL 8, 2024

This includes market analysis, competitor research, financial planning, and creating sustainable business models that drive profitability and scalability. Financial Management and Analysis Financial management is a cornerstone of small business success.

The Management Centre

SEPTEMBER 30, 2020

We all know that risk management is an important part of project planning. Risk management is like a lifeboat in this sea of uncertainty. Here we explore the key steps to effective risk management. What is risk management and why does it matter? risk management creates transparency and builds trust.

Successful Independent Consulting

AUGUST 4, 2022

Supply and demand – Assess the market for your expertise to get an idea of how hard it may be to stand out from the crowd and get work. Benefits – Although health exchanges have made it possible to buy your own insurance, it’s still expensive. If you have to buy your own insurance, will you be able to afford it?

MishTalk

SEPTEMBER 20, 2014

French vegetable farmers protesting against falling living standards have set fire to tax and insurance offices in town of Morlaix, in Brittany. A Russian embargo on some Western goods - imposed over the Ukraine crisis - has blocked off one of their main export markets.

The Fearless Marketer

APRIL 15, 2019

Here’s the opening of an email to executives in the Insurance Industry interested in increasing sales: We’ve all seen this opera a thousand times: Yes, insurance salespeople have been the victim of vicious stereotypes. This opening relies on the stereotype of the obnoxious insurance salesperson. Then call on Dilbert, of course.

Tom Spencer

FEBRUARY 2, 2019

For example, an insurance company might take control of hospitals, primary care providers, home services, or community agencies. In early 2018, CVS Health, a provider of retail pharmacies and healthcare stores, acquired Aetna , an insurance company. Advantages & Disadvantages of Vertical Integration.

Tom Spencer

NOVEMBER 10, 2023

Hedge funds have gained increased attention over the years, with their involvement in financial markets drawing interest from investors, media, and the general public. This relative lack of regulation allows hedge fund managers to implement complex investment strategies and respond quickly to market opportunities.

MishTalk

SEPTEMBER 22, 2014

Link if video does not play: Why Your Plan Was Cancelled: Health Insurance and the Affordable Care Act. What reason might insurers have to cancel plans? Mike "Mish" Shedlock [link] Mike "Mish" Shedlock is a registered investment advisor representative for SitkaPacific Capital Management. So I did some digging.

Harvard Business

AUGUST 15, 2017

One company that’s making headway on that goal is CSAA Insurance Group (CSAA IG), one of the insurance companies affiliated with the 55 million-member American Automobile Association (AAA). With almost 4,000 employees, CSAA IG has embarked on a systemic approach to create a pervasive culture of innovation.

Consulting Matters

SEPTEMBER 30, 2020

Insurance (4:47). All right, moving on to insurance. I’ve listed two types of insurance that I recommend for consulting and coaching clients. And, first of all, business insurance, the general liability, it’s just good for any business. You definitely want to have a managed system for your filing.

Harvard Business

JUNE 23, 2017

The behavioral biases play out in a simple paradox: People overconsume health care but underconsume prevention, and insurers or taxpayers are left with the bill. Of all industries, insurance has a unique opportunity to align its commercial interests with preventive behaviors. The result is a structural transformation of insurance.

Harvard Business

DECEMBER 21, 2017

a venture-backed insurance startup, to provide some reassurance against unexpected events for riders who will be testing its upcoming autonomous shuttle service. Trov is pioneering a cutting-edge approach to insurance that’s ideal for ride-sharing because it’s customized for every trip. Alphabet Inc.’s In April 2017,Tr?v

Tom Spencer

JUNE 9, 2023

Supply chain management is another area where AI is revolutionizing operations. As a result, businesses have the potential to improve inventory management, reduce costs, and increase customer satisfaction through faster and more accurate deliveries. AI can also facilitate rapid prototyping and testing of new products.

Tom Spencer

JUNE 1, 2019

Retail Wealth Management. Large mutual funds have strong relationships with banks, where they are able to pay a trailer fee to bank investment advisors to market their product. However, they also make money via securities lending when other market participants want to borrow their stocks in order to short them.

Harvard Business

AUGUST 28, 2017

It might seem, then, that private insurance can be of little help in addressing climate change. There’s concern that for-profit insurers won’t want to insure risky properties, and that individuals won’t have the wherewithal to buy insurance plans in the first place. Dating back to at least F.

Consulting Matters

APRIL 13, 2023

He applied for a financial manager job at Disney and was one of 1400 candidates. Now, they are in network with all the major insurance companies and have a major partnership with Wounded Warrior Project. Today, Brad Rex shares the real reasons why executives hire consultants and coaches.

MishTalk

NOVEMBER 14, 2013

This time he means it but only for a year, and only if the insurer is willing to bring the plan back. President Barack Obama offered a proposal Thursday aimed at making it easier for Americans whose health insurance plans were slated to be cancelled at the end of the year keep the same coverage through 2014. “I Will insurers bother?

Harvard Business

NOVEMBER 22, 2016

The insurance industry has not been immune to AI’s advancement – whether implementing robo-advisors for investment management (Vanguard and Charles Schwab) or applying AI to insurance and loan underwriting (the Chinese search giant Baidu, which provides enhanced risk assessment capabilities).

Consulting Matters

OCTOBER 30, 2020

Dan Weedin is an author, speaker, consultant, coach, podcaster and founder of Toro Consulting , a firm that specializes in small business growth, particularly in the insurance/risk business. Dan Weedin: Well I'd been an insurance broker for pretty much all of my career. So I had been selling insurance but then I started thinking.

Tom Spencer

DECEMBER 9, 2017

The Maintech Summit at the Frankfurt School of Finance and Management (co-sponsored by Excon , a local start up instigator) is the first real academic-based “shark-tank” environment for disruptive start-ups in Frankfurt. The concept of medical cannabis covered under health insurance has just become law in Germany. Blockchain 2.0

Tom Spencer

OCTOBER 6, 2023

Firstly, by outlining the major items on a bank’s income statement, and then by discussing key ratios that are commonly used to measure profitability and to estimate the market value for banks. For the sake of simplicity, we will present the information in a consolidated manner. Common Equity Tier 1 (CET1) ratio).

Successful Independent Consulting

APRIL 2, 2018

You need to consider the real and perceived value of your services, expertise, and experience, as well as geography and market conditions. Field of expertise — Consultants who can diagnose problems and create sound strategies and actionable plans can charge more than those who focus on more tactical work like project management.

MishTalk

FEBRUARY 27, 2014

Even so, maritime companies, insurers, engineers, labor unions and regulators doubt unmanned ships could be safe and cost-effective any time soon. Try as they might, central banks have only managed to foster asset bubbles (they don''t even see) not the 2% price inflation they want. But what about the job losses? Yet they keep trying.

Tom Spencer

JUNE 16, 2018

According to Oliver Wyman, a global management consulting firm, 90% of Canadian banking customers use digital channels and more than 30% are now banking exclusively virtually. In this context, they provided accessible deposits, savings, loans, and insurance – with relatively limited need to give advice. Image: Pexels.

MishTalk

NOVEMBER 20, 2013

The idea behind Obamacare is to make the young and the healthy overpay for insurance to subsidize everyone else. In an effort to persuade individuals to purchase insurance, the law provides a scale of escalating penalties starting in 2014 and increasing in 2015, then again in 2016. 2014 Penalties 1% of your yearly household income.

Tom Spencer

JUNE 24, 2022

Blockchain has already had a significant impact in the finance industry with the global cryptocurrency market cap now exceeding $1 trillion. Blockchain is also being used to improve supply chain management. Bitcoin is the obvious frontrunner in the world of private cryptocurrencies with a current market cap of more than $500 billion.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content