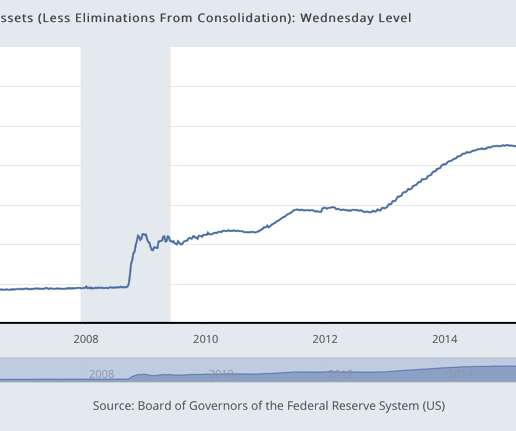

Fed Balance Sheet vs. Stock Market; Will QE Cause Inflation?

MishTalk

AUGUST 7, 2013

Minyanville Business and Market News. Get Involved The State of the Unions Finances: A Citizens Guide. Balanced Budget Ammendment Sign the Balanced Budget Petition. China Financial Markets. Market Oracle. Market Ticker. Real Clear Markets. Fed Balance Sheet vs. Stock Market.

Let's personalize your content