Boosting Business Profitability

Business Consulting Agency

SEPTEMBER 12, 2023

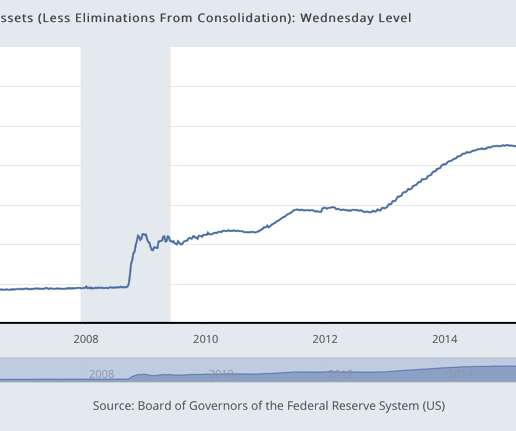

This includes scrutinizing income statements, balance sheets, and cash flow statements. Cost Reduction and Efficiency Improvements Consultants are adept at pinpointing areas where a company can trim unnecessary costs and enhance operational efficiency.

Let's personalize your content