Rising COVID cases, falling economy

Tom Spencer

MAY 2, 2020

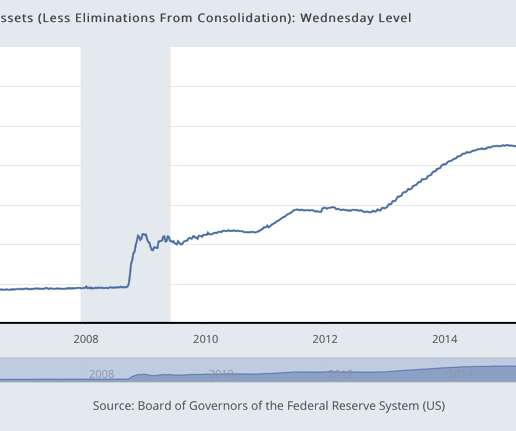

Since the start of February this year, the Fed has expanded its balance sheet by more than $2.4 To put that in context, the Fed was created in 1913, and its total balance sheet assets only reached $2.4 trillion in assets, but only 2 months to achieve the same amount of balance sheet expansion this year.

Let's personalize your content