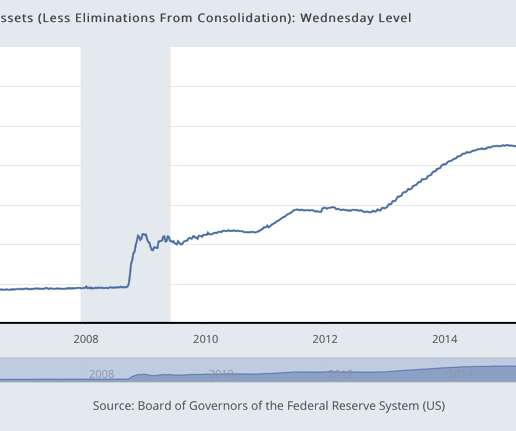

Descent of the Global Monetary System

Tom Spencer

MAY 9, 2020

In the long run, it would seem fairer to base the global monetary system on an asset that is not produced exclusively by any one nation and which people are generally willing to accept as valuable. Bretton Woods System: 1944 – 1971. The Bretton Woods System created a kind of monetary discipline.

Let's personalize your content