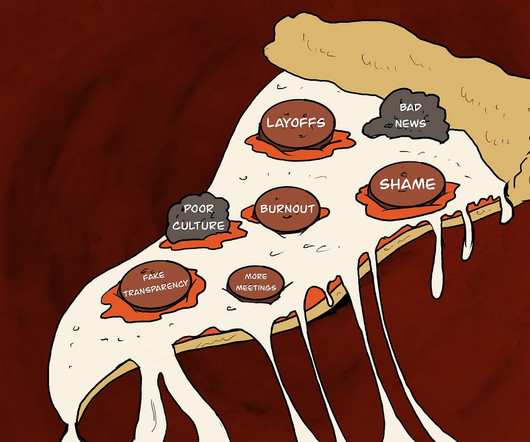

You Can’t Pizza Party Your Way to a Great Corporate Culture

Harmonious Workplaces

DECEMBER 18, 2023

The uncertainty of the market, unstable cash flow, and the seemingly never-ending threat of recession may force companies to make tough decisions. Some of these strategies include: Use Free Lunch Productively: Forbes reported on a study of 1000 workers nationwide within workplaces offering free meals (Cording, 2022).

Let's personalize your content