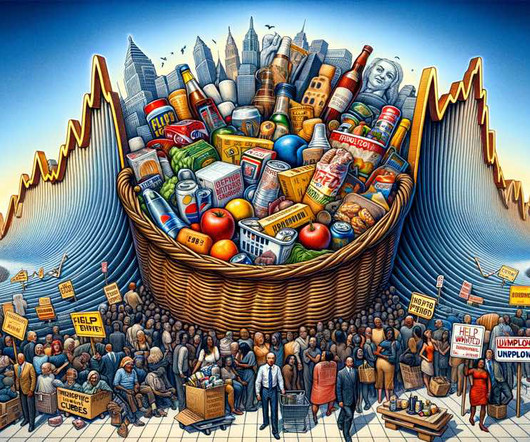

Inflation: Understanding its Impact on the Economy

Tom Spencer

JANUARY 26, 2024

Since 2008, the rate of inflation in the U.S. For example, a dozen eggs cost around $1.00 For example, the Federal Reserve aims to achieve 2% inflation as an ideal benchmark to avoid its counterpart, deflation. remained stable, at or below the Fed’s 2% target. in January 1990 compared with more than $5.00

Let's personalize your content