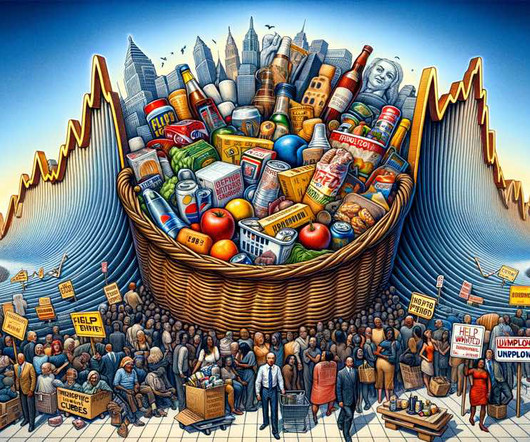

Inflation: Understanding its Impact on the Economy

Tom Spencer

JANUARY 26, 2024

Since 2008, the rate of inflation in the U.S. For example, the Federal Reserve aims to achieve 2% inflation as an ideal benchmark to avoid its counterpart, deflation. Businesses also need to pay more for inputs, like raw materials and labour, leading them to scale back production or further increase prices.

Let's personalize your content