Descent of the Global Monetary System

Tom Spencer

MAY 9, 2020

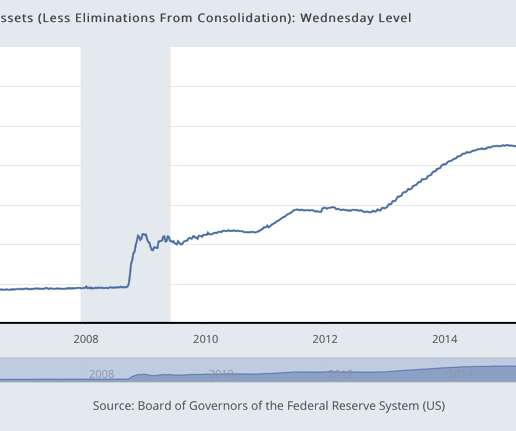

In this context, it is worth noting that rising prices also tend to show up in asset price bubbles, such as the Japanese Asset Price Bubble of 1986 to 1991 , the Dotcom Bubble of the 1990s , and the US Housing Bubble of 2002 to 2006. While focusing intently on consumer prices, central banks tend to ignore rising asset prices.

Let's personalize your content