Descent of the Global Monetary System

Tom Spencer

MAY 9, 2020

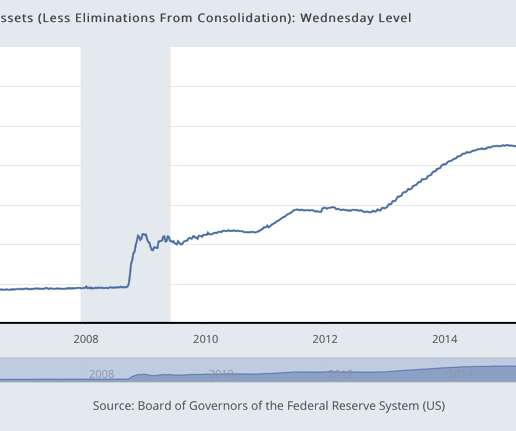

For example, if the US government spends more than it collects in taxes, it can finance the budget deficit by selling bonds. However, when confidence eventually returns and the rate of spending starts to rise, at that point, the Federal Reserve will not be able to reduce the money supply by shrinking the size of its balance sheet.

Let's personalize your content