The Cantillon Effect

Tom Spencer

AUGUST 12, 2020

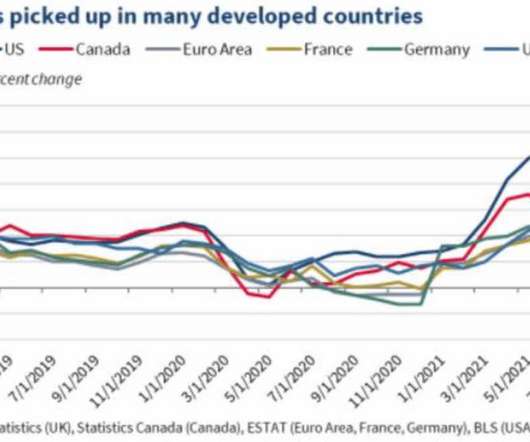

However, national governments and central banks have different ideas. Governments guarantee bank deposits in order to prevent bank runs. In 2020, the Fed has galloped over the precipice, increasing its balance sheet by around $2.8 This inadvertently removes each bank’s incentive to act prudently.

Let's personalize your content