The Cantillon Effect

Tom Spencer

AUGUST 12, 2020

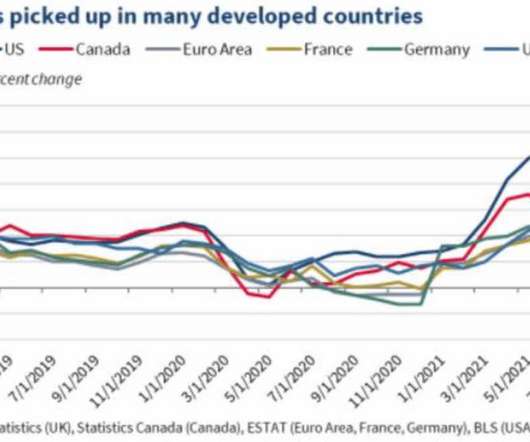

Responding to high levels of debt and financial instability, one would expect to see each bank try to protect itself by shrinking its loan book. This inadvertently fuels asset bubbles and financial instability. In 2020, the Fed has galloped over the precipice, increasing its balance sheet by around $2.8

Let's personalize your content