Rate Hike Cycles, Gold, and the “Rule of Total Morons”

MishTalk

SEPTEMBER 21, 2017

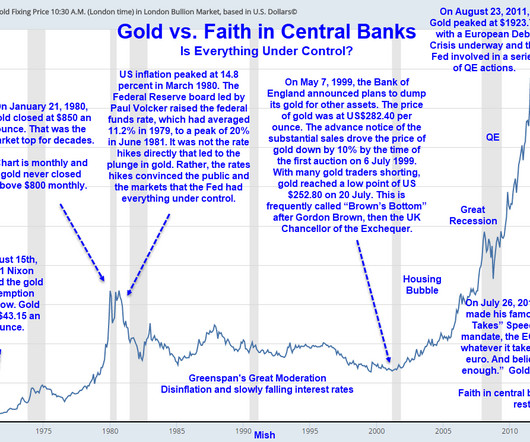

In response to Janet Yellen’s everything is OK speech following today’s balance sheet reduction notice by the FOMC committee, I received an interesting set of comments from Pater Tenebrarum at the Acting Man Blog regarding rate hike cycles, gold, and stock market peaks. That is no coincidence.

Let's personalize your content