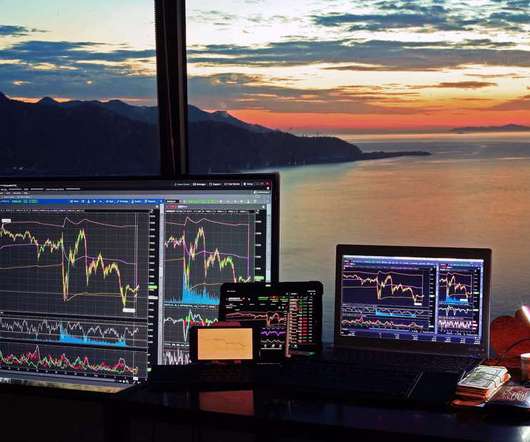

Investment Banking 101: Understanding the Industry

Tom Spencer

FEBRUARY 10, 2023

Investment bankers work on behalf of both individual and institutional clients to raise capital by issuing securities, as well as to advise clients on financial matters such as mergers, acquisitions, and other corporate finance activities. How would you value a company with negative historical cash flow?

Let's personalize your content