This is the second article in a series about the U.S. Federal Reserve. The Fed has significant influence over much of the U.S. economy, which in turn impacts economic growth and government policies worldwide. Thus, Jeremy Powell, current chairman of the Fed, is arguably the most powerful man in the world — in some ways more than the President.

This article explores how the Fed uses tools like the federal funds rate and money supply to shape economic outcomes, including inflation. We also delve into the ongoing debate about the Fed’s power and independence in economic decision-making.

The Fed influences the world economy

Professors in banking and finance often use the metaphor of the economy as a plane and the Fed as the pilot. According to this analogy Chairman Powell, like the pilot of a Boeing 747, can guide the world economy through takeoff and a “soft landing”.

The federal funds rate and the required reserve ratio can be compared to levers in the plane that the Fed can pull to influence the level of economic activity.

The federal funds rate determines the cost of interbank borrowing in the overnight money market, which influences the interest rates that banks charge on consumer and business loans. The cost of borrowing directly influences the amount of consumer and investment spending, and thus the level of economic activity.

In addition, the reserve ratio that commercial banks are required to maintain places a limit on the proportion of bank deposits that banks can lend out. If the Fed wants to stimulate economic activity, they can lower the reserve ratio. This will immediately increase the supply of loanable funds, which should increase bank lending, increase the money supply, and thus the level of economic activity.

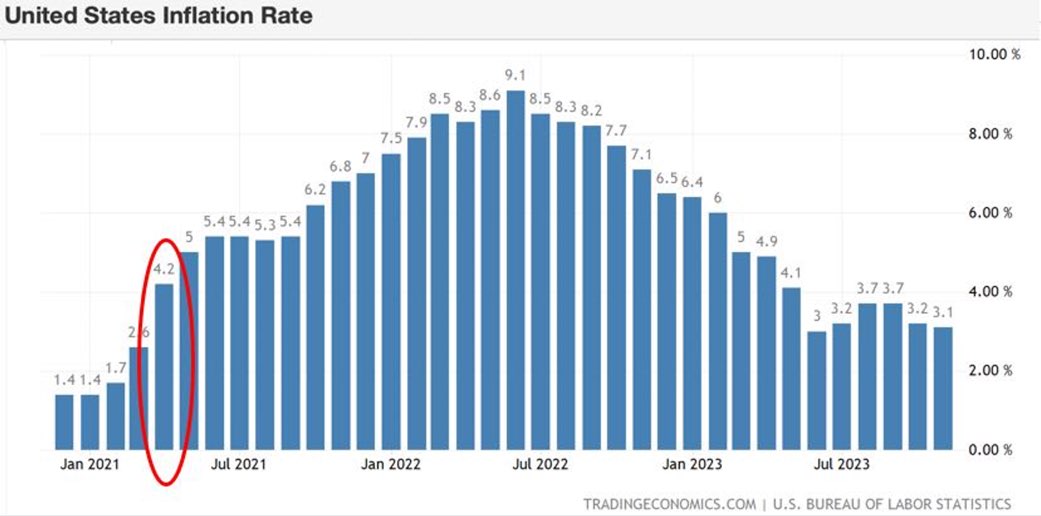

More money supply means more dollars chasing after goods and services, which typically translates into price inflation. However, there is often a time lag between increasing the money supply and rising inflation. For example, when the Fed purchased $1.7 trillion in Treasury securities between March and June 2020, spending on non-essential items like travel and entertainment continued to decline due to the government imposed lockdowns and resulting economic uncertainty. However, the monetary stimulus acted like a seismic event, initiating a financial tsunami that would eventually reach the shores of the economy. In April 2021, more than a year after the Fed opened the monetary tap, inflation started to jump upwards, and remained elevated for over 2 years.

(Source: Trading Economics)

The control panel in the Fed’s cockpit has various instruments that display critical flight information such as the rate of inflation, unemployment, and economic growth. However, the Fed’s instruments are fairly inaccurate and unresponsive, and so often display lagging economic indicators. This means that the Fed doesn’t become aware of key changes in the economy until they have already taken place.

One economic indicator that the Fed measures is the monetary base, which includes currency in circulation plus reserves held at the Fed. This type of money is sometimes referred to as ‘high powered money’ because it determines the extent to which banks can increase the money supply through the fractional reserve banking system. As you can see in the graph below, the monetary base has increased dramatically since 2007.

(Source: Federal Reserve Economic Data)

The rapid increase in the monetary base during 2020 resulted from the U.S. government borrowing to fund efforts during the COVID-19 pandemic and programs such as the ironically named Inflation Reduction Act. This may explain recent inflation. However, as I’ve mentioned, it took until April 2021 for price inflation to start kicking in.

After the inflation tsunami had made landfall, the Fed took almost another year to respond. But when it did respond, it responded vigorously, raising the federal funds rate at a record pace from 0% to 5.5% from March 2022 to July 2023. Given its aggressive response, there has been ongoing debate about whether the Fed will be able to bring down inflation without triggering a recession.

Will the Fed be able to bring the economy in for a soft landing?

The Fed could bring about a soft landing

In a recent review of economic downturns and their links to the Fed’s policy choices, Professor of Economics Alan S. Blinder pointed to the Fed’s track record of bringing down inflation while avoiding a recession.

Blinder argued that, if guided by a less-aggressive attitude towards inflation and not jolted by market shocks such as oil price hikes or major tax hikes, the Fed’s efforts to calm inflation can be effective at bringing about a soft landing.

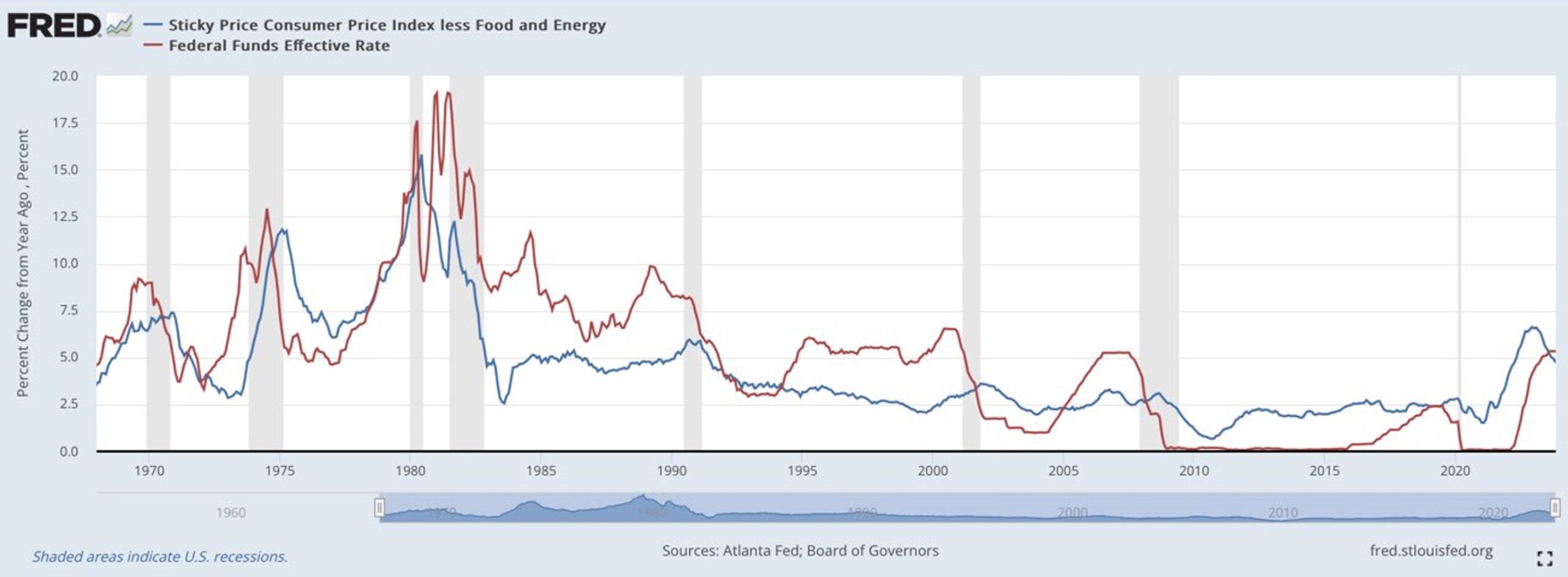

Publicly available data appear to support Blinder’s view. The graph below shows inflation and interest rates in America from 1968 to 2023. The red line represents the federal funds rate, while the blue line indicates the percent change in CPI, a fairly common measure of inflation. The grey shaded vertical bars represent periods of recession. The graph shows that the Fed has for the most part managed to maintain a low and stable rate of inflation since the mid-1980s while at the same time keeping periods of recession relatively short by slashing the federal funds rate when required (see, the Greenspan Put).

(Source: FRED)

The Fed may have too much power

Many consider the Fed to have too much power, and some even call for its complete elimination. Austrian school economists point out that periods of loose monetary policy encourage banks to extend credit at artificially low interest rates, which leads to an artificial boom and a misallocation of resources (malinvestment). The artificial boom causes competition for scarce resources, price inflation, and higher interest rates that cause an inevitable bust when unproductive businesses are forced to close their doors.

Many argue that the US economy performed better before the Fed was created. With the exception of the Great Moderation of the 1990s, research suggests that economic performance in America has deteriorated under the Federal Reserve, with lower economic growth and higher inflation.

In a recent article about the future of the Fed, former Fed Vice Chair Randal Quarles warned that it is dangerous for the Fed to provide a direct line of credit to individuals, businesses, and governments. There are two reasons why this is likely to be the case. Firstly, the Fed can type on a keyboard to print new money, meaning the Fed is not constrained by the discipline of a budget, which means it can create rapid price inflation. Secondly, this form of financial support does not require legal authorisation from Congress. During COVID, the Fed showed that it has the power to lend directly to businesses and local municipalities. There is nothing to stop the Fed from abusing this power in the future when another ‘emergency’ arises.

The bottom line

The Fed serves as a crucial force in steering the economy, using tools like interest rates and the money supply to manage inflation.

Recent increases in the monetary base due to government borrowing during the COVID-19 pandemic have raised concerns about the role of the Fed in causing a period of high inflation, and whether this can be remedied without causing a recession.

The ongoing debate over the Fed’s power, decision-making independence, and the potential risks associated with its extensive control and monetary tools underscores the complexity and significance of its role in shaping the economy.

Wes Brooks is an incoming Summer Business Analyst at Cicero Group and an undergraduate studying economics, management, and strategy. He is a serial entrepreneur, works in venture capital, and enjoys singing a capella and piano improvisation.

Image: DALL-E 3