What are Mental Models?

Becoming a better thinker requires you to understand the way you think, how you view the world, and developing a way of approaching problems that allows you to see things through multiple lenses. We refer to these lenses as ‘mental models’.

Mental models are tools for the mind that are built on the foundations of physics, biology, math, psychology, as well as history and economics.

Furthermore, mental models can be classified into various categories:

- Models that simulate a particular point in time, either the present or the past, which help us predict the future.

- Models that help us understand our mental processes (anchors and biases) and how they lead us astray.

- Models of equilibrium, which can take a myriad of forms, with the most famous being the economic model of supply and demand.

You can think of mental models as tools in your mental toolbox. The more tools you have, the more problems you will be able to solve. The more problems you can solve, the greater your ability to surmount obstacles. And the more you understand reality, the better the decisions you will be able to make in order to achieve your goals and, along the way, acquire new tools that enable you to understand the world.

In this sense, mental models are additive. Like LEGO. The more you have, the more things you can build, and the more likely you are to be able to determine the relevant variables that influence the situation.

As you learn new mental models, you will face a number of interesting questions:

- Where will these tools be useful?

- Under what conditions could these tools fail?

- And, perhaps most importantly, given that the world is continuously changing, which tools should you prioritise learning and keep sharpened in your toolbox?

Models should not only be consistent overtime but relevant in a diverse range of environments. When it comes to the world of business and consulting, you will benefit from learning models that change slowly and are sufficiently high level that they can be applied when analysing any particular industry or company.

Formulating Strategic Decisions Based on Industry Analysis

While often criticised as being overly simplistic, frameworks like SWOT and Porter’s Five Forces are routinely taught in business school. Their popularity derives from their simplicity as well as their flexibility. Porter’s Five Forces has provided a foundational mental model for strategic management since it was developed by Professor Michael Porter in 1979. It provides a reliable method for understanding the competitive intensity of an industry and thus how easy it will be for a company in that industry to make a profit. This is something that graduating students, start-up founders, and senior managers would all do well to understand before taking action to pursue a particular career, start a particular business, or pursue a particular growth, diversification or repositioning strategy.

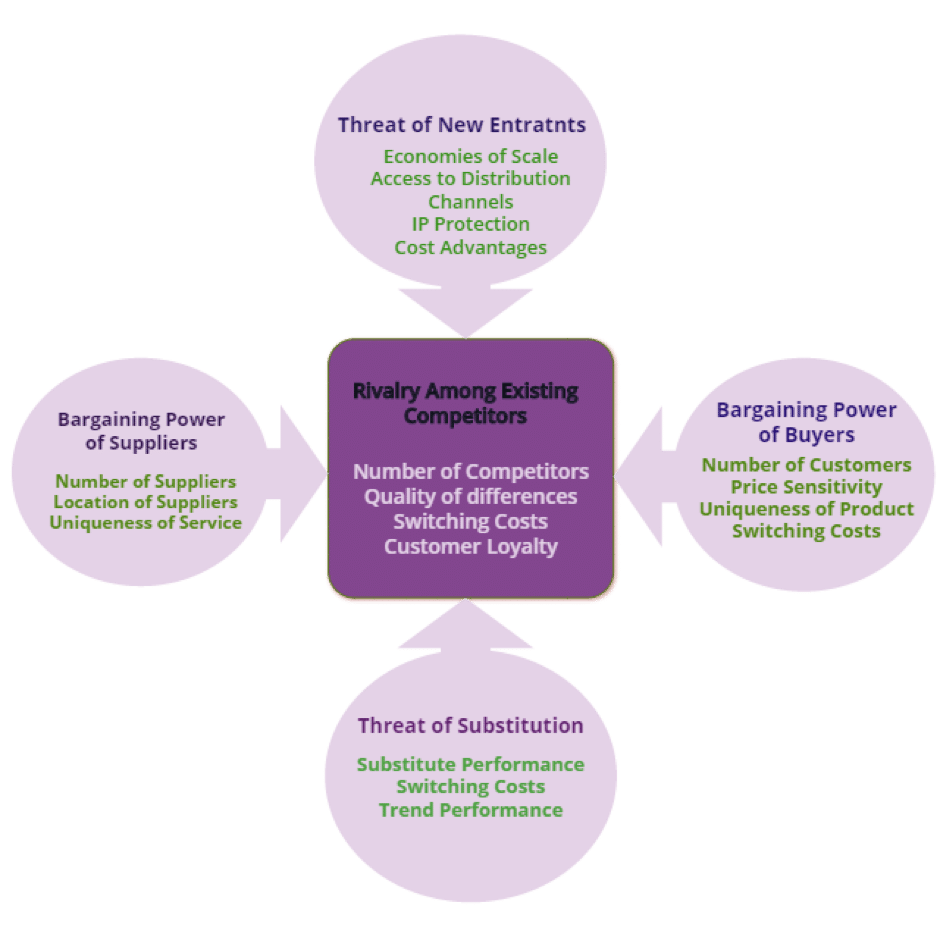

The model indicates that the state of competition in an industry depends on five basic forces.

This model is great for deciding whether one should either enter a new industry or develop a new strategy for an organisation within that industry. As a result, a good number of decisions within the consulting and entrepreneurial field employ this model.

Here is a quick preview of core components of the model:

- Rivalry Among Existing Competitors may lead to competitive pressure in an industry that can manifest in various ways: price wars (e.g. the oil price war between Saudi Arabia and Russia), advertising wars (e.g. Coke vs Pepsi), or new products that attack a competitor’s market (e.g. Red Bull’s Simply Cola and Coke’s Monster Energy). Competitive pressure puts a limit on the profit potential of firms in the industry. In industries where there is fierce competitive rivalry, firms tend to contend with each other for market share and profit margins are inevitably lower.

- Threat of New Entrants to an industry means that there is potential for new capacity to be unleashed into the market. This creates a risk for companies in the industry that in the future there may be more competing products and services fighting for a share of the customer’s wallet. This threat can put pressure on prices, costs and the amount of investment necessary to deter new entrants. An essential task for firms is to determine the presence of barriers to entry and to anticipate the possible response of competitors when considering entering an industry.

- Bargaining Power of Suppliers refers to the ability of suppliers to negotiate favourable trade terms with firms in the industry. If there are few suppliers who produce relatively unique products, or suppliers can credibly threaten to integrate forwards into the industry’s business, then they may wield significant power over the industry. Suppliers can exercise their bargaining power by raising prices or reducing the quality of products they supply to the industry.

- Bargaining Power of Buyers refers to the ability of buyers to negotiate favourable trade terms: higher quality products, better customer service, and lower prices. Buyers have the greatest bargaining power when they are large and are able to switch comfortably to products from other firms.

- Threat of Substitute Products and Services refers to the indirect competition that comes from other industries who offer to solve the customer’s problem in different ways. For more generic, undifferentiated products, the threat is always higher than for differentiated products. If customers have several substitutes available that offer an attractive price-performance trade-off then it will be difficult for firms to raise prices and make a profit.

Whether you think a mental model is important or not, it’s crucial to remember the primary value in learning mental models is to get you ready to act quickly in new situations where you don’t have complete information.

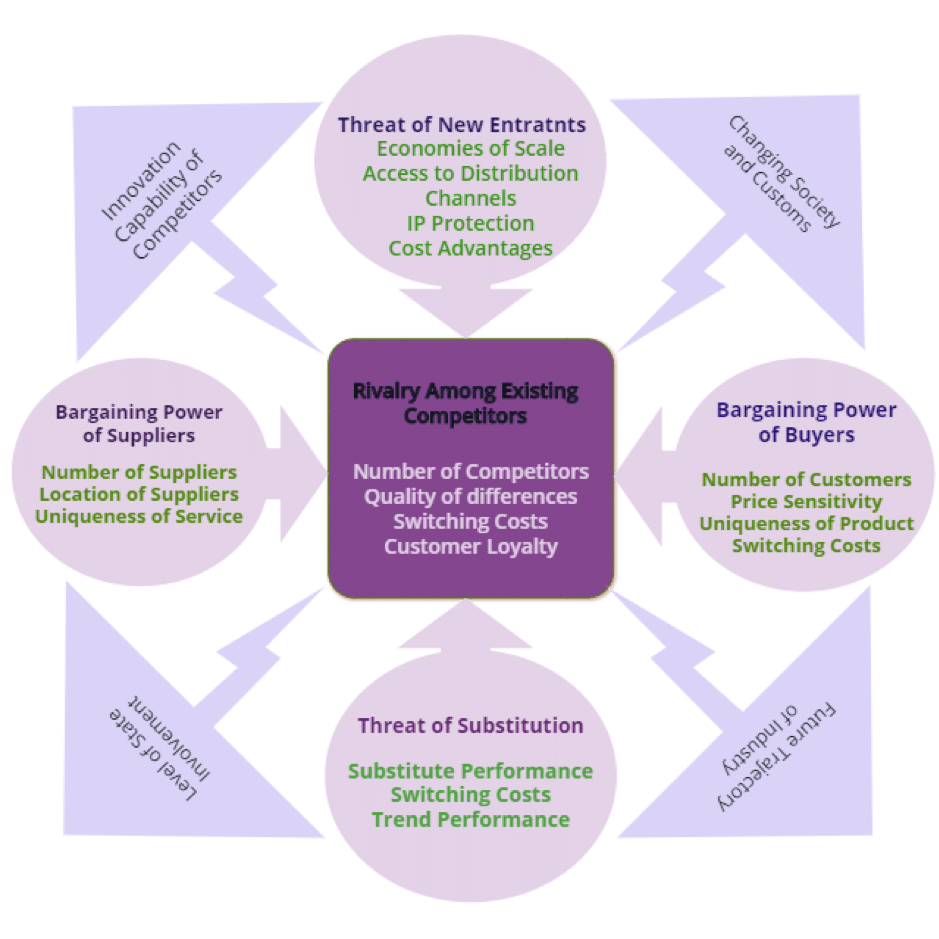

Since all models are wrong or limited in their ability to map reality, it can be fun to notice certain shortfalls of a model or envision ways of enhancing it.

Looking at the Porter’s Five Forces, I would integrate it with other big picture issues and challenges that can impact an industry.

Making the Decision

For consultants, the purpose of applying a model is to provide recommendations. The ultimate goal is to help entrepreneurs and senior managers make fast and reliable decisions. Herbert Simon, an American economist famous for the theories of “bounded rationality” and “satisficing”, described the difference between experienced decision makers and novice ones in his autobiography ‘Models of My Life’:

“A large part of the difference between the experienced decision maker and the novice in these situations is not any particular intangible like “judgment” or “intuition.” If one could open the lid, so to speak, and see what was in the head of the experienced decision-maker, one would find that he had at his disposal repertoires of possible actions; that he had checklists of things to think about before he acted; and that he had mechanisms in his mind to evoke these, and bring these to his conscious attention when the situations for decisions arose.”

As such, if you have more than one model; you can look at a problem from a variety of perspectives and increase the odds of making decisions that produce a desirable outcome.

Oduor Ochieng is an Econmics Honors student at the University of Cape Town. He has experience working in a Medical startup and Fintech company.

Source: Pixabay

🔴 Interested in consulting?