In the previous article, we looked at how banks make money and how they must meet capital requirements. In this article, we will explore the importance of profitability ratios and valuation metrics that are crucial when analyzing banks.

There are seven key profitability ratios and two valuation metrics that it is important to understand. We will examine each in turn.

1. Profitability ratios

- Net interest margin (NIM)

- Efficiency ratio

- Return on assets (ROA)

- Fee income to total income

- Return on equity (ROE)

- Dividend payout ratio

- Total shareholder return (TSR)

1.1 Net interest margin (NIM)

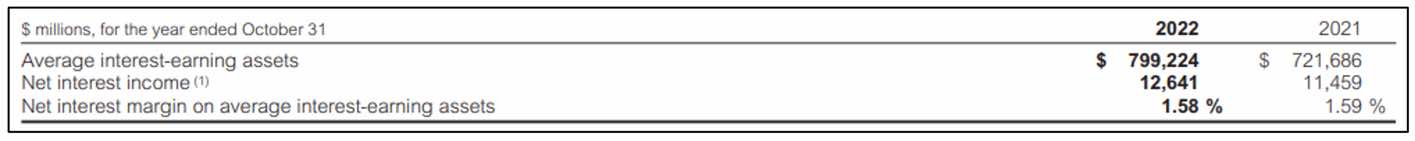

Net interest margin measures how much net interest income is generated from a bank’s asset base. It is the difference between a bank’s interest income from loans and investments and its interest expenses paid to depositors and creditors divided by assets. That is, net interest income divided by assets.

A higher net interest margin is preferred, unless it is achieved by taking a material level of incremental risk (riskier assets normally generate higher yields).

Image 1: Illustrative example of a bank’s net interest income and margin

Source: CIBC’s 2022 Annual Report

1.2 Efficiency ratio

The efficiency ratio measures effective cost management and operational efficiency, and is defined as non-interest expenses divided by revenue. All else being equal, a lower number is better. This measure is useful when comparing similar business lines or when comparing a particular business line over time. It is not a useful metric for comparing different business lines.

As an example, corporate lending is characterized by very low efficiency ratios (a good thing) but also low ROE given the large amount of capital charges. Wealth management, on the other hand, has high efficiency ratios (a bad thing) given a compensation structure that rewards individual advisors generously for the strength of their client relationships, but also a generally high ROE given low capital requirements.

1.3 Return on assets (ROA)

ROA measures a bank’s ability to generate profit from its assets (net income divided by assets). All else being equal, a higher ROA is better as it indicates stronger profitability and more efficient asset utilization. However, it is possible for a bank to boost its ROA in the short run by pursuing riskier areas since losses are unlikely to materialize for a few years. So, a higher ROA is not always better.

Return on risk-weighted assets or RoRWA (net income divided by risk-weighted assets) is another measure that is used. Unlike ROA, it attempts to “equalize” assets based on their risk level. This metric would reward firms that are generating low spreads on low-risk assets.

1.4 Fee income to total revenues

Fee income to total revenues is a useful directional indicator of revenue diversification between non-lending and lending areas, although it is not perfect. A higher ratio of fee income implies less traditional credit risk and less balance sheet usage (therefore higher ROE) but also implies greater market risk related to securities portfolios and potentially higher revenue volatility related to volatility in capital markets.

1.5 Return on equity (ROE)

ROE, defined as the ratio of net income to average common shareholders’ equity, is a key measure of profitability.

It provides insights into how effectively a bank utilizes shareholder capital to generate profits. A higher ROE indicates better profitability and efficiency in utilizing shareholder capital. It signifies that the company is generating a higher return on each dollar of equity invested.

1.6 Dividend payout ratio

The dividend payout ratio is defined as the ratio of common share dividends paid as a percentage of net income after preferred share dividends, premium on preferred share redemptions, and distributions on other equity instruments (i.e. dividends paid as a proportion of net income).

Key criteria for considering whether a bank can increase dividends is the bank’s current level of payout relative to the target payout ratio, and its view on the sustainability of earnings.

1.7 Total shareholder return (TSR)

TSR is often considered the ultimate measure of shareholder value, and the outcome of delivering against the financial targets. It reflects the total return earned by shareholders over a specific period through both capital appreciation (changes in stock price) and dividend income.

TSR = Capital Appreciation + Dividend Return

Capital Appreciation = ((Ending Stock Price – Starting Stock Price) / Starting Stock Price) x 100

Dividend Return = (Total Dividends / Starting Stock Price) x 100

TSR considers the overall financial performance of a bank and the impact on its stock price. It’s also important to note that TSR is influenced by various factors beyond a bank’s direct control, such as market conditions, industry trends, and investor sentiment.

2. Valuation Metrics

- Price-to-earnings (P/E)

- Price-to-book (P/B)

2.1 Price-to-earnings (P/E)

The most commonly used method to value banks is price-to-earnings (P/E), measured as the ratio of the bank’s stock price to its earnings per share (EPS). It helps assess the bank’s market value relative to earnings. A higher P/E ratio may indicate a relatively higher valuation or market expectations of future growth.

The following attributes generally lead to banks trading at higher P/E ratios relative to their peers:

- Higher and more visible prospects for earnings growth

- Perceived quality of earnings (securities gains, trading revenues, and “other” earnings are often discounted given their opaque and unpredictable nature)

- Business mix that is higher in wealth management, followed by traditional retail banking, followed by wholesale banking

- Perceived quality of management

- Comfort (or lack thereof) regarding potential capital deployment

P/E ratios tend to be ignored in times of rising credit losses and deteriorating equity markets. In those conditions, bank earnings tend to deteriorate rapidly and generally come in below analyst expectations. It becomes more difficult to use P/E as a guide to near-term share price performance if investors do not have faith in estimated earnings. In a scenario where earnings estimates are declining (usually driven by weakening credit conditions or weak capital markets), investors tend to focus on the price-to-book (P/B) valuation methodology.

2.2 Price-to-book (P/B)

The P/B ratio compares a bank’s stock price to its book value per share. It measures the market’s valuation of the bank relative to its net asset value.

While P/E is the most commonly used way to value banks in “normal times”, P/B multiples should not be ignored, and their importance increases when the earnings outlook is murky.

However, P/B has generally become a measure that is less useful than it was in the past since banks’ balance sheets are not as important as they used to be in determining earnings power. This can be seen by looking at the evolving business mix of banks over the last 30 years. Net interest income (which is generally balance sheet driven) declined to approximately 50% of revenues in recent years from representing almost 80% of revenues in 1980.

Concluding Thoughts

It is important to note that these financial metrics should not be evaluated on a standalone basis. When analyzing the profitability and valuation of banks, it is crucial to consider them in conjunction with other relevant factors and benchmarks to gain a more comprehensive understanding of the financial performance. Some important considerations include: industry and peer comparisons, historical performance analysis, market conditions, and macroeconomic factors.

Jason Oh is a Senior Associate at Strategy& with a focus on financial services. Previously, he was part of the Global Wealth & Asset Management Strategy team of a large financial institution and served EY and Novantas in their strategy consulting practice.

Image: Pexels