“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” ~ John Maynard Keynes

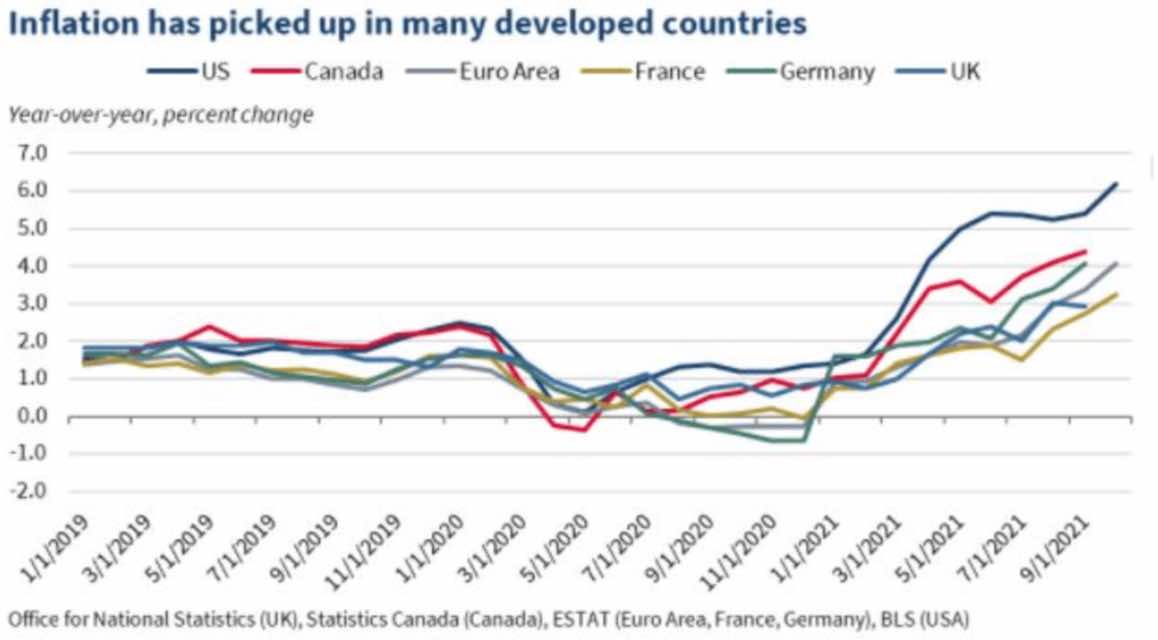

Inflation in America is currently running hot, with the official rate hitting 6.2% in October, its highest level since 1990. Some market commentators saw this coming, and those same players predict that higher inflation will persist. This is likely to have wide ranging implications for the economy, investors, and individuals.

6 reasons inflation is higher than you think

Although the inflation rate is currently at 30-year highs, there are six reasons to believe that inflation is far higher than the official statistics suggest.

1. The definition of inflation has changed

The generally accepted definition of inflation has changed over time.

In 1913, the year that the US Federal Reserve was created, the definition of inflation was “an undue expansion or increase … of currency”.

In 2021, over a hundred years later, the definition used by mainstream economists is “an increase in the general level of prices in the economy”.

The former definition focuses on currency creation, i.e. the source of inflation, whereas the latter definition focuses on rising prices, i.e. a symptom of inflation.

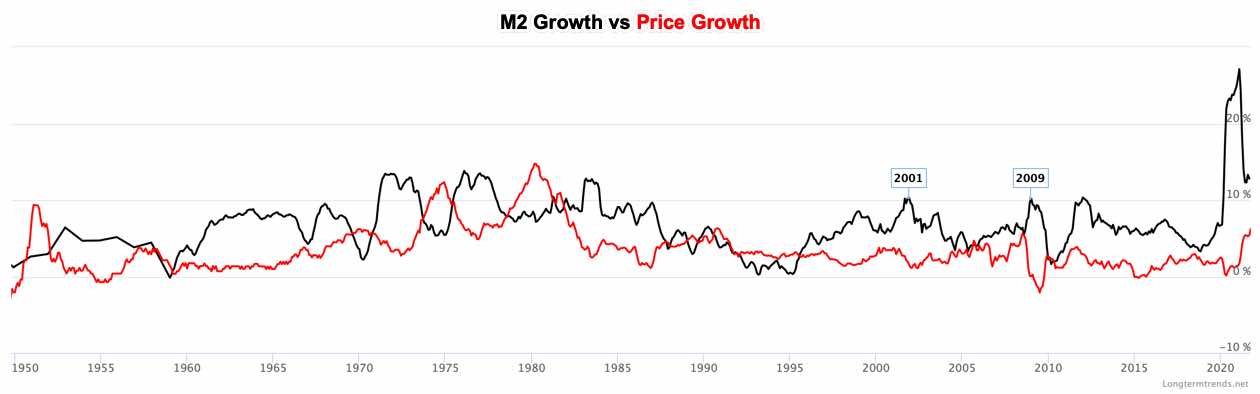

Figure 1: Growth in M2 vs Growth in Price Level, 1950 – 2021

The changed definition of inflation has allowed the man on the street to remain blissfully unaware of inflation even as the value of the US currency has continued to plummet. Figure 1 above shows that the black line (growth in the money supply) is almost always above the red line (growth in the price level) for the period 1950 to 2021. Due to improved technology and rising productivity, the Federal Reserve has been able to juice the money supply for more than 70 years without it showing up too much in the price level.

2. The measure of inflation has changed

Inflation is measured by changes in the Consumer Price Index (CPI), an index that tracks the average price of a basket of goods and services purchased by a typical urban consumer.

The exact method of doing so has changed over time. If inflation were calculated the same way today as it was in the 1970s, the inflation rate would currently be running at close to 15%.

3. Consumer substitution does not reduce inflation

Substituting a lower priced good for a higher priced good can allow a consumer to avoid the full impact of inflation. In order to take this into account, government agencies (e.g., USA, Australia) have adopted methods that presume some substitution within categories, e.g., cars, when calculating the CPI.

However, allowing for substitution when calculating the CPI understates inflation. For example, imagine a consumer wants to buy a BMW but responds to run-away inflation by buying a Honda Accord instead. Although the consumer avoids paying for the higher priced car, they also fail to get the car they want. A reduction in choice and living standards is a real cost, and the CPI does not take this into account.

4. Quality adjustment understates inflation

Hedonic adjustment aims to adjust the CPI for changes in quality over time. For example, a Nokia 3210 (popular circa 2000) and an iPhone 13 are both cell phones. However, hedonic adjustment would suggest that the price of the iPhone 13 needs to be adjusted downwards to take into account that the characteristics of the product have improved.

Using hedonic adjustment reduces the accuracy and reliability of the CPI, and understates the true rate of inflation. While it is often possible to measure consumer prices objectively, quality is completely subjective. Since quality usually improves over time, this method also leads economists to consistently adjust prices downwards.

5. Government has an incentive to cheat

Governments have an institutional incentive to understate inflation.

Since pension entitlements and welfare payments are often indexed to inflation, understating the true rate of inflation can help the government to reduce its financial liabilities.

In addition, tax brackets are often increased each year to reflect inflation. If inflation is understated, taxpayers are likely to be pushed into higher tax brackets, which allows the government to collect more taxes without amending the tax code.

6. CPI is an aggregate measure

The CPI is an aggregate measure of the price level, which means that different consumers will face different rates of inflation depending on which goods they choose to buy.

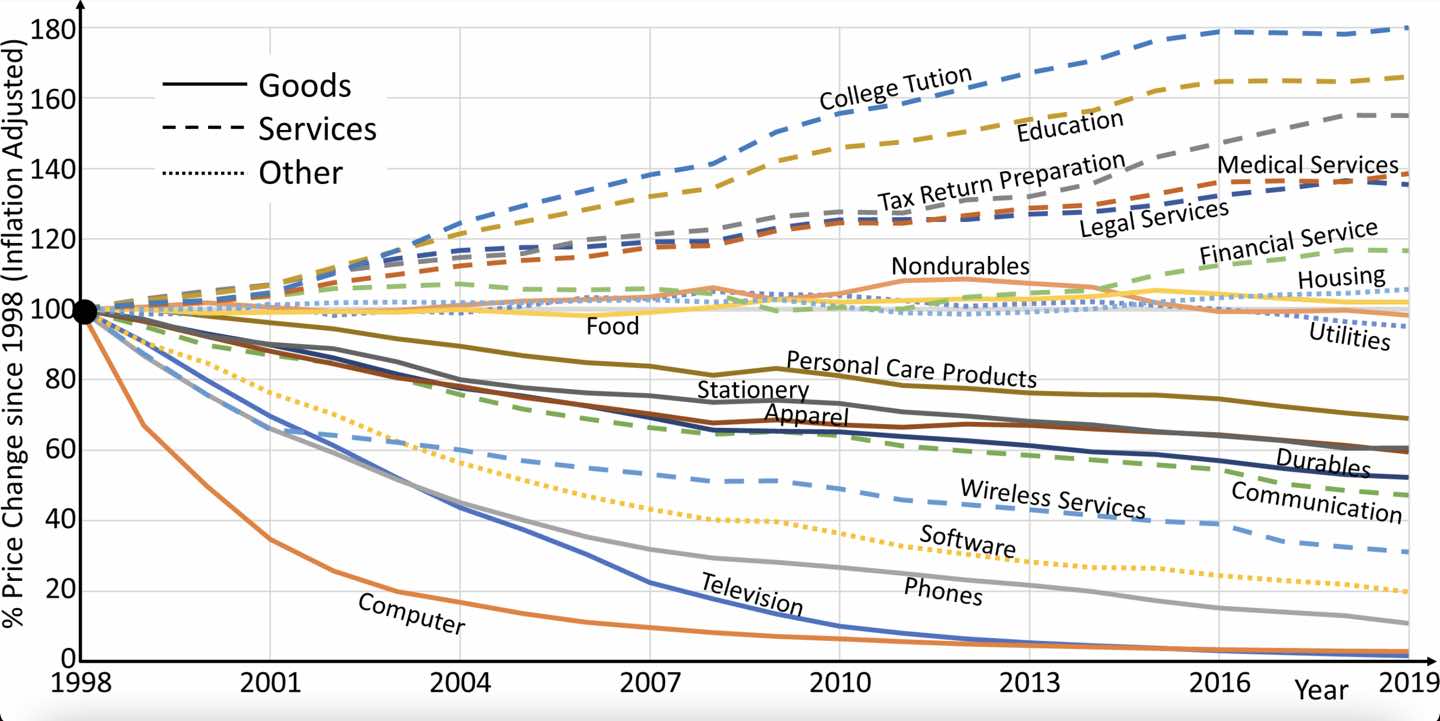

Figure 2: Inflation Adjusted Price Changes since 1998

According to Figure 2, the price of some consumer goods have fallen since 1998 (e.g., apparel and electronics), but the price of other consumer goods have risen sharply (e.g., education, medical services, legal services).

Reduced access to certain goods creates structural inequality, a real cost of inflation that does not show up in the CPI. For example, a consumer who has new clothes, a new phone, and a new computer, but who can’t afford high quality education, medical, and legal services, does not really have equal access to the fruits of economic progress or the ability to fully participate in the economy.

High inflation will likely persist

In January, the US inflation rate was around 1.4%, but by April it had jumped to 4.2%. While this may not seem high, it is a full 2.2% above the Fed’s target rate.

In order to settle inflationary concerns, Federal Reserve Chairman Jerome Powell has consistently stated that inflation is likely to be temporary, a view he reiterated in August at the Jackson Hole economic symposium. This sentiment has also been echoed by ECB President Christine Lagarde and other central bank governors, who have indicated that rising prices will be “largely transitory going forward“.

With US inflation now running at 6.2%, and likely to jump still higher, the ‘transitory inflation’ narrative will be difficult to sustain going forward. The prices of some goods are rising much more quickly than the average rate measured by the CPI. Energy prices jumped 50% in the last 12 months, and food prices jumped more than 1.2% in September (an annualised rate of 14.4%).

Policy makers have been quick to point the finger of blame away from themselves. Powell has argued that high inflation is mostly caused by supply chain disruptions and a vigorous recovery as the economy reopens coming out of the pandemic. Treasury Secretary Janet Yellen has also blamed inflation on the pandemic, arguing that people sitting at home shopping online has led to demand-driven price increases.

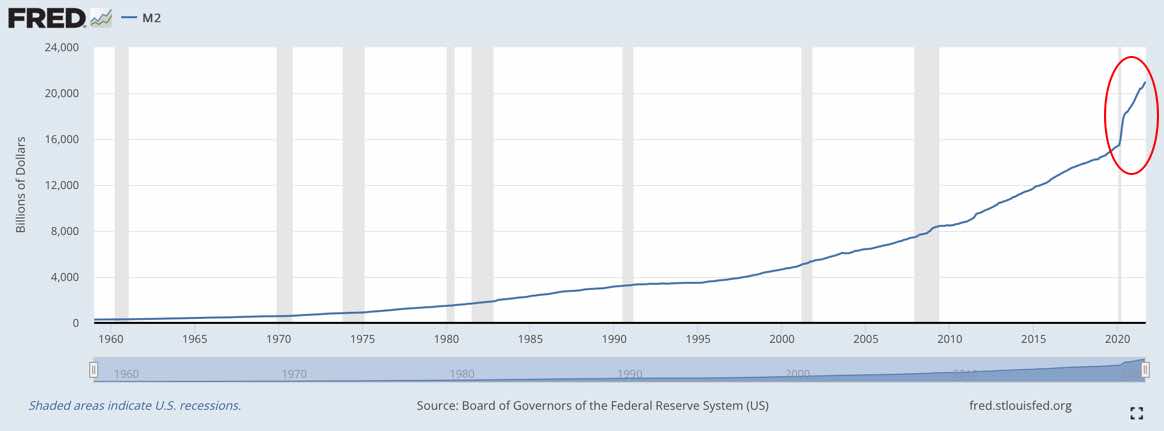

However, where did all of the extra money come from to fuel all of this increased spending? Figure 3 below shows that more than 35% of all US dollars in existence (measured by the M2 money supply) were created since January 2020.

Figure 3: M2 Money Stock, 1960-2021

In a tacit admission of guilt, and a signal that inflation is unlikely to be temporary, Yellen has taken the surprising step of suggesting that inflation is a good thing for society. She has indicated that higher inflation may eventually lead to higher interest rates and that this “… would actually be a plus [from] society’s … and the Fed’s point of view”.

Inflation is transitory.

Inflation is not transitory, but it is not our fault.

Inflation may be our fault, but it is actually a good thing.

🤡 🌍

Since the US dollar is the global reserve currency, we have focused on the American inflation story. However, it is worth noting that high inflation is a global trend. In October, inflation was above the typical 2-3% target rate in many countries including the UK (4.2%), Germany (4.5%), Canada (4.7%), India (4.5%), South Africa (5%), Spain (5.4%), Turkey (19.9%), Argentina (52.1%), and Zimbabwe (54.5%).

The significance of high inflation

High rates of inflation produce winners and losers. Inflation is often described as “an increase in the general level of prices in the economy”. When inflation runs hot, the amount of goods and services people can buy with a given amount of money falls quickly, and so the real value of incomes and savings shrink. This is a problem for workers, savers, and creditors who have a contractual claim to a fixed amount of cash. However, it can confer a benefit on businesses, owners of real assets, and borrowers who are able to raise prices, enjoy capital gains, or repay loans with money that has less value.

For the US economy, run-away inflation is likely to be devastating, producing a deep economic recession, a currency collapse, or both.

Since higher inflation generally leads to higher interest rates (because lenders want a positive real interest rate), high inflation would cause a severe economic contraction as interest payments rise and spending falls by a corresponding amount. This is already impacting home sales, and Fannie Mae forecasts home sales will fall for the next 2 years.

America is awash in debt, and higher rates will place many borrowers in financial distress. US government debt currently stands at around US$29 trillion, US corporate debt stands at over US$11 trillion, and the combined debt of households and non-profits stands at over US$17 trillion. An increase in interest rates by 8.2% (the current inflation rate plus a 2% real interest rate) would lead to an increased interest expense for the US economy of around $4.7 trillion dollars per year. In other words, economic armageddon.

In order to prevent rates from rising, the Fed will most likely pursue a policy of aggressive Quantitative Easing, which means buying up all of the debt securities it can get its hands on.

A period of aggressive QE could persist for some time. While the total assets on the Fed’s balance sheet are currently more than $8 trillion, there is more than $57 trillion of total debt in the US economy.

Following this path will significantly increase the money supply, and ultimately spell the end of the US dollar as a store of value and global reserve currency. Some commentators (e.g. Jack Dorsey) are already predicting hyperinflation.

If high inflation, economic recession, and currency crises are a distinct possibility in the near future, investors can position themselves by acquiring real assets, and doing so before the herd of other investors stampede in the same direction. Ludwig von Mises referred to this scenario as a crack-up boom, a situation where continual credit expansion and a collapse in the monetary system cause prices to rise rapidly as investors abandon the currency in favour of commodities and other real assets.

A period of high inflation and economic recession will impose reduced living standards and economic hardship. In a potential foreshadowing of things to come, The White House, the Federal Reserve, and the media have all signalled that Americans should lower their expectations. White House Press Secretary Jen Psaki has downplayed supply chain shortages as “the tragedy of the delayed treadmill” while the Fed has suggested that Americans should switch from poultry to soybeans for Thanksgiving.

People approaching retirement age could be the hardest hit by high inflation. Most pension funds are invested in fixed income investments, and when interest rates rise the price of these assets will fall. Traditionally, American pension funds only invested in US Treasuries and investment grade bonds, however since interest rates have been so low for so long, many pension funds are also invested in high-yield bonds (i.e. junk bonds). Although these investments offer higher interest rates, they also carry far more risk that the issuers will default, meaning that many pensioners could lose their retirement nest eggs.

The bottom line

Although inflation is running at multi-decade highs, the true rate of inflation and its cost on society is likely higher than most people are aware. Not only has the definition and method for calculating inflation changed over time in ways that obscure the issue, but the real cost imposed on society due to reduced choice, falling living standards, and increased structural inequality are habitually overlooked.

Inflation is unlikely to be transitory, and you can protect yourself from the full impact of run-away inflation by owning real assets, e.g., gold, silver, land, buildings.

Taking action sooner rather than later, before everybody wakes up to the threat posed by inflation, may allow you to position yourself without paying unduly high prices. As to what you buy, when, how much, and at what prices, these are question that only you can answer. Talk to some experts, and consider your other assets, investment goals, and personal risk profile before taking action.

🔴 Interested in consulting?

2 replies on “6 Reasons Inflation is Higher than You Think”

[…] to the Federal Reserve’s determination to curb inflation it has consistently hiked interest rates for the last 12 months, an outcome that SVB and many other […]

[…] depending on currency demand, trade volumes, interest rates, relative economic performance, and inflation. When considering whether to offshore production, forecasts about exchange rates can mean the […]