Coronavirus & Consulting Offers

Tom Spencer

SEPTEMBER 19, 2020

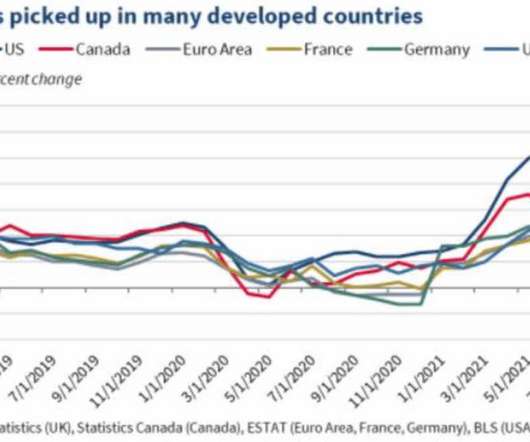

If the virus isn’t under control by May 1 st 2021 and the economy hasn’t picked up, do recruiters have plans to push back start dates? If the firms don’t have a strong balance sheet, if they foresee a potential cash flow problem, or if they have clients in particularly hard hit industries, I’d be concerned. Today, not so much.

Let's personalize your content