Lehman Brothers and other investment banks went down in part due to the huge amounts of money they lost in the sub-prime mortgage crisis. As a result of the crisis, there was less money available for consumption and investment activity, and businesses found it difficult to re-finance existing loans. This led to economic paralysis and stagnation, and the global financial system remains weak to this day.

While earning a certain level of income is necessary for survival, difficulties arise when the drive for constant growth and high incomes becomes the primary objective. The objective of constant growth is incompatible with a world that has limited physical, biological and energy resources. Furthermore, research consistently suggests that, beyond a certain point, having more money does not increase a person’s wellbeing.

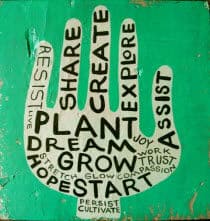

Today, September 15th, is Free Money Day! Organised by the Post Growth Institute, Free Money Day is a global event in which people hand out their own money to complete strangers (two coins or notes at a time), and ask recipients to pass half to somebody else. The day aims to spark conversations about the benefits of economies based on sharing. Questions that may come up in your conversations today are ‘how much money is enough?’, ‘do we always need to grow our economies?’, and ‘would sharing make more common sense?’

Happy Free Money Day!

🔴 Interested in consulting?

2 replies on “Kickstarting the Gift Economy”

Free Money Day was covered by Huffington Post yesterday: http://www.huffingtonpost.com

Just stumbled across your blog, and your current post struck a responsive chord. Here is a recent post from my blog on “growth”:

http://jumptoconsulting.com/you-do-want-to-grow-dont-you/

Small can be good, particularly for consultants.

Best Wishes,

Daryl