When’s the last time you invested in yourself?

Or, if you’re a business owner, how often do you invest in your business?

One of the primary reasons people start a business is to build wealth.

But when it comes to investing in themselves and their business, they try and spend as little as possible.

What do you do when you want to save more money? You invest in more savings.

So if you want to improve your skills and grow your business, invest more money into yourself and your business.

By the end of this post, you will understand how to build wealth by investing in your business — your primary wealth-generating asset.

IMPORTANT: This is NOT financial advice. We are not making any recommendations for what you should do. We are merely sharing our own opinions and experience.

It all starts with a simple mindset switch…

The Best Return on Investment: Your Business

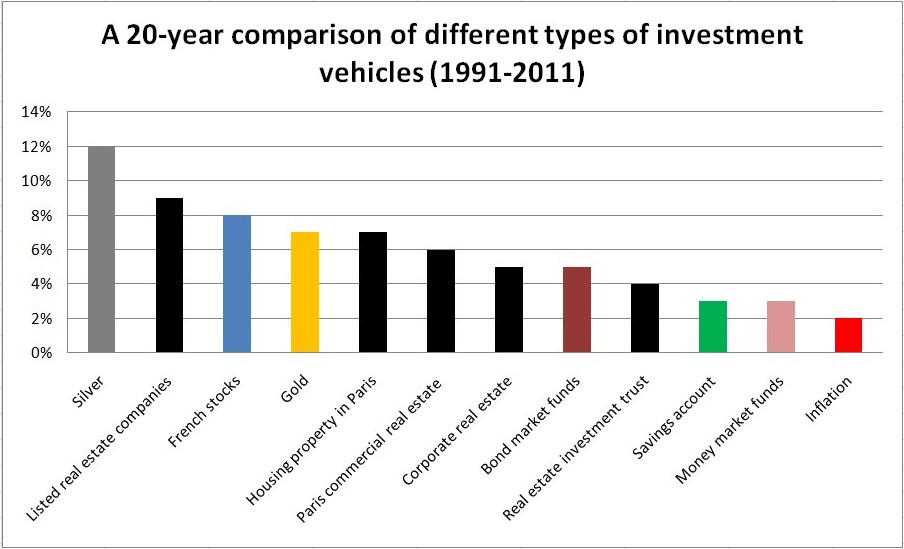

Which investment vehicle do you think will generate you the highest returns?

Index funds? Real estate? Cryptocurrency?

What if I tgoldbroker.com/news/investmeold you it was none of the above?

Or, better yet, what if I told you there was an investment you could make that could generate a predictable and consistent 300% ROI — or even more?

Traditional investment vehicles can be excellent, low-risk options.

But investing in your business will provide you with an exponentially higher ROI.

Example: You’re a consultant, and each client project you win is worth around $25K.

What could you do to invest in your business to get more clients at $25K each?

- You could invest $1k or more into ads or content that gets you and your message in front of your ideal client.

- You could invest in your education as a consultant and learn how to market and sell your services more effectively.

- You could invest in a part-time marketing freelancer at $2K per month, who helps to market and sell your services for you.

None of these are expenses because they provide a return on your investment. You invest in one of these options, and they have the ability to create more $25K projects for you.

Where else can you make a relatively small investment and have the ability to double, triple, even quadruple your return on investment?

If you compare the returns you’ll get by investing in your marketing or sales, you’ll see far greater returns than investing in something like index funds.

This is a big part of how I’ve built my own 7-figure portfolio.

My Story: Building A Multi-Million Dollar Portfolio

Over the course of my career, I’ve been fortunate enough to build a multi-million dollar portfolio. I’ll share what’s worked best for me and what I’m doing now.

My first principle is this: you cannot save your way to wealth.

That’s not to say that saving isn’t important — we’ll get to that later. But my businesses have been the primary engine for wealth creation.

Many consultants and service providers are far too conservative. They view everything as an expense — even if said “expenses” will generate revenue for their business. This is a mistake.

By investing in the business — that is making investments in our own coaches and mentors, education programs, building the team, content and ad development, tools, and technology — I, along with my team, have been able to grow a highly profitable business…and that asset creates a return like no other I’ve seen in traditional investments.

Now, here are the steps I’ve taken to build a multi-million dollar portfolio:

- I started by investing in the stock market. Anyone can do this, with virtually any budget. Start as small as you need. Just get the habit going.

- Every month, I increased my monthly investment. You have to be patient with this, but over time, your money will compound and start to work for you. If you can increase your investment every month, it will speed up the process.

- After I accumulated more capital, I began investing in real estate. I invested in a few apartment units. Then, I purchased a home in Vancouver. After that, I invested in the company office.

Notice the diversification. I’ve invested in everything from mobile home parks to early-stage start-ups.

I follow this simple rule for investing:

The less confidence I have in something, the less money I put in it. But if I have more confidence in it, I’ll invest more money into it.

By sticking to these rules, over time, my portfolio has grown. I’m at the point where I manage more of my money. My money has started to work for me — leveraging what I’ve already created.

But until you’re at the point where you are comfortable managing your own money, make it easy with automation.

How To Save Money With Automation

Ever notice how hard it is not to spend money when it’s sitting in your daily checking account?

When you get a big juicy paycheck, it takes a lot of willpower and discipline to save any of it.

Let’s remove the need for willpower and discipline out of the equation using automation.

Here’s what you can implement in the next 25 minutes that will get you started: create a second savings account.

Then, set-up an automatic transfer that automatically deposits 10% (or as much as you can) of your monthly revenue to an investment account.

If you do this — and stick with it — you’ll automate a big part of the wealth-building process.

While you are working on your business, your money is working in the background: compounding and growing.

Trying to save money manually is playing the wealth-building game on hard mode.

Instead, make it automatic. Without you even noticing that money coming out each month you are creating wealth.

One day, you’ll open your investment account and be pleasantly surprised by how much money you’ve saved and the wealth you’ve built.

Again, none of this is investing or financial advice. Talk to experts. I don’t know your specific situation and so can’t give specific advice on what to buy and when to buy it. This is simply what has worked for me and what I continue to do.

Taxes & Insurance: Considerations & Advice

Taxes & insurance are “dry” topics — but they are a crucial part of building wealth.

First things first: if you are a business owner, hire a professional accountant.

This is one of the biggest “no-brainer” investments you can make. A professional accountant who specializes in small business will save you far more money than you spend/invest with them. And, it will save you time and energy, which are two of your most crucial resources.

I’m not an insurance expert. But I have several policies in place to ensure my family will be financially stress-free if anything was to ever happen to me.

A simple term policy is a great way to get started. The cost is low but it’s really an investment in peace of mind.

When your income starts to increase, there are insurance policies that allow you to access money from your business tax-free. It can also provide you with tax/estate benefits and insurance coverage at the same time.

Again, this is not formal financial advice. Talk to experts in these areas who can help you. Hire ones who show you how you can save money. The right accountant and insurance will help you do just that.

Action Step: Invest In Yourself (And Your Business)

Now it’s time for you to put this into action.

Your action step for this article is to make an investment in yourself and your business.

How much you’re able to invest depends on your budget.

Examples of investing in yourself:

- $: Buy a non-fiction book about a business you admire, so you can gain inspiration and learn the inner-workings of the business so you can apply them to your own.

- $$: Attend a conference so that you can network with like-minded people or potential clients, increasing your pool of referrals.

- $$$: Hire a mentor or coach that can help you develop a specific and customized plan for your situation to help you achieve your goals faster (in areas like fitness, health, relationship, mindset).

Examples of investing in your business:

- $: Take a course so that you can level-up an aspect of your business that you know could be better.

- $$: Hire a contractor so that they can take some of your low-level tasks off your plate, allowing you to work on higher-level work.

- $$$: Hire a mentor or coach that can help you develop a specific and customized plan for your situation to help you achieve your business goals faster.

Choose one of the options above. The more you invest, the higher your returns generally will be.

You’ll notice that the higher investments are more personalized. A book is inexpensive, but not customized to you. It will take you longer to get results.

Coaching/consulting is more expensive, but it is customized to you. Working with an expert is the fastest way to get your desired result.

“If hiring a new team member helps you free up time to land just one client, it’s well worth it.”

—Dauwn Parker, Clarity Coaching Client

If you remember one thing from this article, remember this: these examples are not expenses that drain your accounts.

These are investments that, in the longer term, will grow your wealth.

What are you doing to invest in yourself and your business?

Where have you seen the highest returns from doing so?

Leave a comment and share what’s working for you!